What Establishes Mortgage Lenders in Omaha In Addition To Various Other Areas

What Establishes Mortgage Lenders in Omaha In Addition To Various Other Areas

Blog Article

Discover the Perfect Home Mortgage Broker for Your Home Loan Demands

Selecting the appropriate mortgage broker is a crucial step in the home funding procedure, as the proficiency and sources they provide can substantially influence your monetary end result. Knowing where to start in this search can frequently be overwhelming, increasing the concern of what details top qualities and qualifications truly set a broker apart in a competitive market.

Comprehending Home Mortgage Brokers

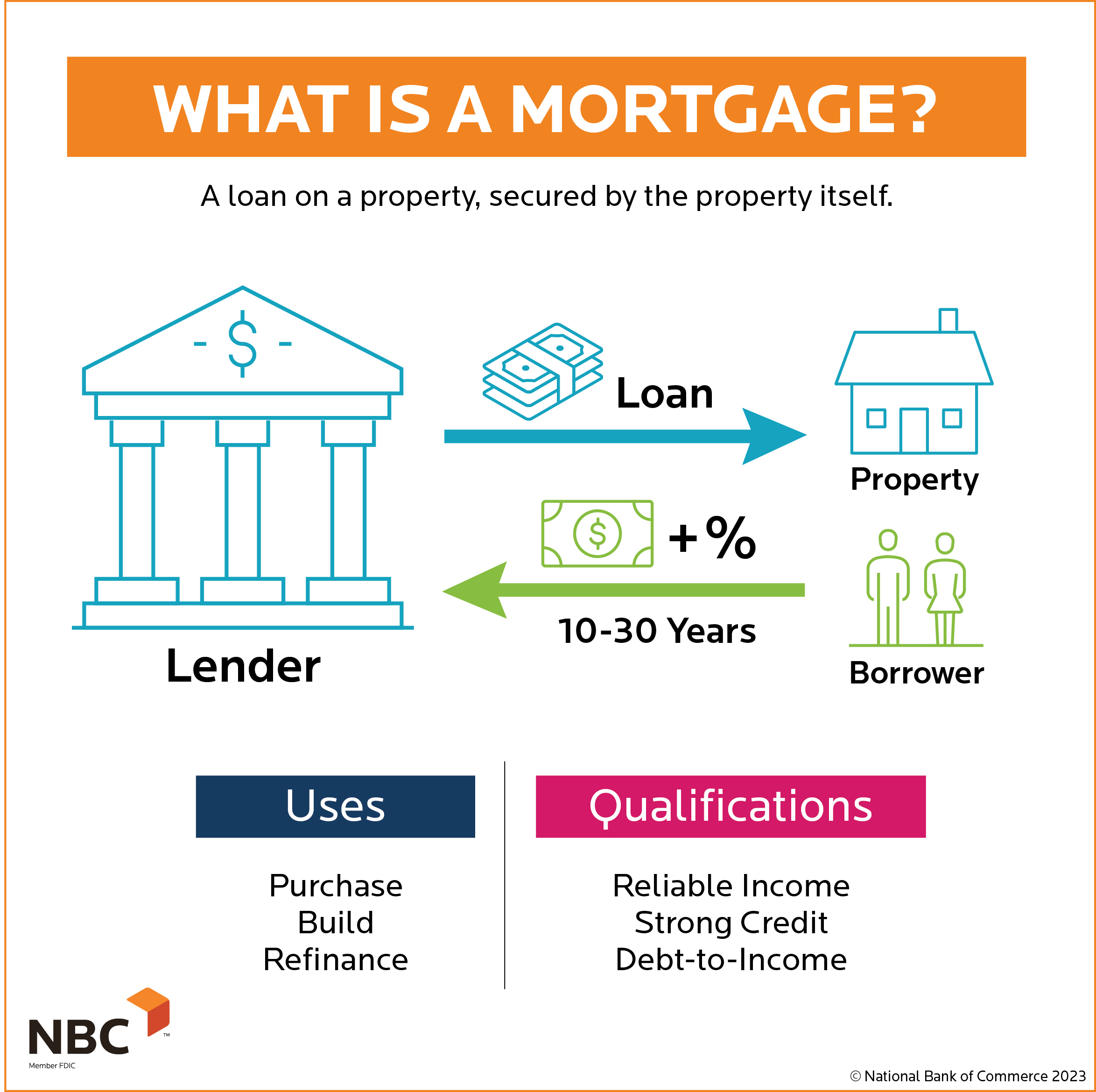

Understanding mortgage brokers is essential for browsing the intricacies of home funding. Home loan brokers offer as intermediaries in between lenders and customers, helping with the process of protecting a home mortgage. They have substantial understanding of the loaning landscape and are proficient at matching clients with suitable lending items based on their monetary accounts.

A vital feature of home loan brokers is to analyze a debtor's financial scenario, consisting of credit history, income, and debt-to-income proportions. This examination allows them to suggest mortgage alternatives that straighten with the debtor's capacities and requirements. Furthermore, brokers have accessibility to a range of lenders, which allows them to existing multiple loan choices, possibly causing more desirable terms and prices.

By making use of a mortgage broker, customers can conserve time and lower stress and anxiety, making sure a more reliable and educated home financing experience. Comprehending the function and advantages of mortgage brokers ultimately empowers property buyers to make informed decisions throughout their mortgage trip.

Secret High Qualities to Try To Find

When picking a home loan broker, there are numerous vital qualities that can dramatically impact your home financing experience. Look for a broker with a solid reputation and positive customer reviews. A broker with pleased clients is likely to give reliable service and sound suggestions.

A broker with comprehensive industry understanding will be much better furnished to navigate complex mortgage choices and offer customized options. A broker who can plainly describe terms and processes will certainly ensure you are educated throughout your home mortgage trip.

Another crucial high quality is openness. A trustworthy broker will honestly discuss charges, potential problems of interest, and the whole borrowing process, allowing you to make informed decisions. Search for a broker who demonstrates solid negotiation abilities, as they can protect much better terms and prices in your place.

Last but not least, consider their availability and responsiveness. A broker who prioritizes your demands and is readily available will certainly make your experience smoother and less difficult. By examining these key high qualities, you will be much better positioned to find a home mortgage broker that lines up with your home mortgage requirements.

Questions to Ask Potential Brokers

Choosing the right home mortgage broker involves not only identifying key top qualities yet also involving them with the ideal concerns to determine their competence and suitable for your requirements. Begin by asking concerning their experience in the industry and the kinds of lendings they specialize in. This will certainly aid you comprehend if they align with your details monetary situation and objectives.

Inquire about their procedure for analyzing your economic health and wellness and figuring out the very best home mortgage options. This concern discloses just how thorough they are in their technique. Additionally, ask concerning the variety of lenders they collaborate with; a broker that has access to numerous lenders can supply you extra affordable prices and choices.

Understanding just how they are compensated-- whether with ahead of time costs or payments-- will certainly offer you understanding right into potential conflicts of interest. By asking these targeted concerns, you can make an extra educated decision and find a broker who best matches your home lending demands.

Researching Broker Credentials

Completely looking into broker qualifications is an essential action in the mortgage option procedure. Making certain that a mortgage broker possesses the appropriate qualifications and licenses can dramatically affect your mortgage experience - Mortgage Broker. Begin by verifying that the broker is certified in great site your state, as each state has details demands for home mortgage professionals. You can commonly locate this info via your state's regulatory company or the Nationwide Multistate Licensing System (NMLS)

Additionally, discovering the broker's experience can supply understanding into their know-how. A broker with a proven track document in successfully closing finances similar to yours is very useful.

Moreover, examine any kind of disciplinary activities or complaints lodged against the broker. Online testimonials and reviews can supply a glance into the experiences of past customers, assisting you evaluate the broker's reputation. Eventually, detailed research study into broker credentials will certainly equip you to make an educated decision, fostering confidence in your home loan procedure and enhancing your general home getting my sources experience.

Evaluating Costs and Services

Examining services and charges is typically a crucial element of picking the right home mortgage broker. Openness in fee frameworks allows you to compare brokers efficiently and assess the total expense of acquiring a mortgage.

In enhancement to costs, take into consideration the array of services used by each broker. Some brokers supply an extensive collection of services, including monetary assessment, aid with paperwork, and continuous assistance throughout the financing process.

When reviewing a broker, ask about their my link availability, responsiveness, and determination to address questions. A broker that focuses on client service can make a considerable distinction in browsing the complexities of home mortgage applications. Inevitably, recognizing both services and fees will empower you to select a home loan broker that lines up with your monetary requirements and expectations, making sure a smooth course to homeownership.

Verdict

To conclude, picking an appropriate home mortgage broker is important for accomplishing positive funding terms and a structured application procedure. By prioritizing brokers with strong reputations, comprehensive experience, and access to multiple lenders, people can boost their opportunities of safeguarding affordable rates. Additionally, examining interaction abilities, fee frameworks, and overall transparency will certainly add to a more educated choice. Ultimately, a knowledgeable and reliable home mortgage broker acts as a valuable ally in browsing the complexities of the home loan landscape.

Selecting the best mortgage broker is a crucial action in the home car loan procedure, as the know-how and resources they offer can considerably affect your financial result. Home mortgage brokers serve as intermediaries between customers and lending institutions, assisting in the procedure of securing a home loan. Recognizing the role and benefits of home loan brokers inevitably empowers property buyers to make informed decisions throughout their home loan trip.

Making certain that a mortgage broker has the proper certifications and licenses can substantially affect your home loan experience. Eventually, a credible and well-informed mortgage broker offers as a valuable ally in navigating the complexities of the mortgage landscape.

Report this page